The Micro-Social Impact Bond v. 2.5

What is the Micro-Social Impact Bond?

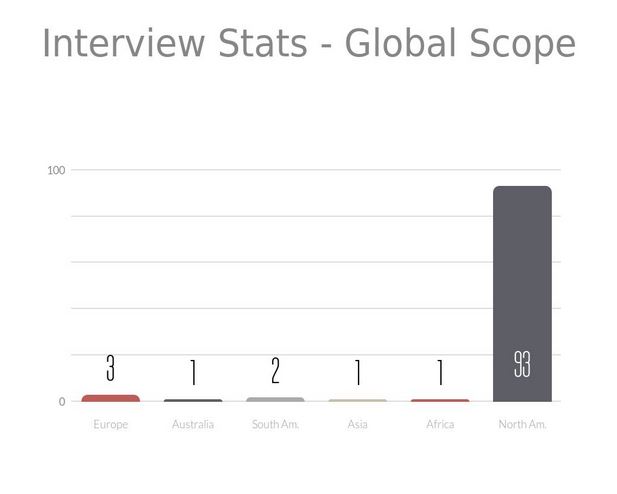

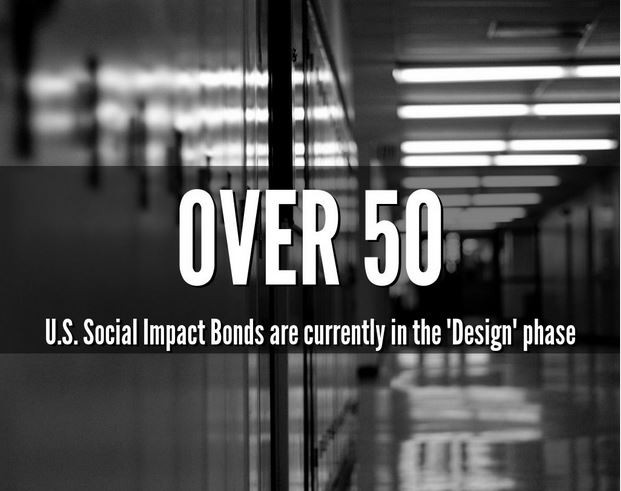

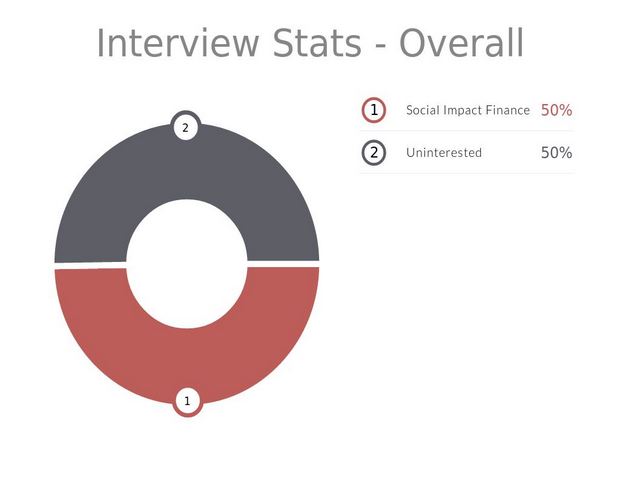

The Micro-Social Impact Bond (Micro-SIB) v. 2.5 is a unique social impact financing tool, invented by Infinite 8 Institute, Founder and Chief Innovation Officer, Ean Garrett, J.D., to fuel social innovation in the 21st Century digital economy. How we communicate and exchange information and value has completely changed how we conduct business and interact socially with other human beings. In the earlier part of this decade, the concept of Social Impact Bonds (SIBs) or paying for successful outcomes became somewhat trendy but still has yet to dominate the mainstream. As a result, we seek to enhance the utility and accessibility of the SIB, by making it smaller, more agile, more predictable, and effective. The collective product of our work and years of experience toward creating sustainable social impact solutions is the Micro-SIB.

3-Dimensional Structure

Like our physical reality, which has 3-dimensions (width, height, and depth), the Micro-SIB has three true dimensions. The three dimensions of the Micro-SIB consist of the Investors, the Intermediary, and Philanthropy. The Investors provide much needed resources, while receiving a return in the form of interest plus the initial investment. As the Intermediary we facilitate the transaction, provide consulting, program design and engineering, coalition building, advocacy, fund-raising, and technical assistance along the way. Philanthropy provides the leverage through grant appropriations to pay for successful outcomes, pay a small premium for such outcomes, and gain a bigger bang for their buck by only funding successful outcomes.

Micro-SIB Definitions

Initial Investment = Service-cost per Beneficiary x Number of Program Beneficiaries

Primary Profit = Initial Investment + Negotiated Interest Rate

Government Savings = Total Accumulated Cost-savings

IMPACT = Quantifiable Total Accumulated Cost-savings determined an independent assessor

Metrics = Impact Reporting & Investment Standards (IRIS) & Global Impact Investment Reporting System (GIIRS), or as otherwise agreed

Our Roles = Intermediary

Estimated Creation Time = > 12 months

Capital Requirement = $150k-$10M USD

The Initial Investment can be solidified from Venture Capital, Angel Investors, Banking Institutions, and Institutional Investors in the private sector. The Primary Profit consists of the payments promised to the initial investors by the Outcome Investors, upon the achievement of pre-agreed upon quantifiable outcomes. In Micro-SIB's where the outcomes are achieved primarily concern human capital, payments are made on a per-capita basis for outcomes. Formal Municipal Bonds can also be created similar to the Human Capital Performance Bonds (HUCAP), in which government acts as an administrator of undsment funds, prividing leverage for investors and service providers. Government Savings are the Total Accumulated Cost-savings as a result of the intervention. And IMPACT is measured by the Total Accumulated Cost-savings to the Government.

Learn more about how your organization can benefit from Micro-Social Impact Bonds, please click here.